The 5 Most Important Personal Finance Lessons to Teach High School Students

Financial literacy is an important life skill that should be taught to high school students. Of course, there are many ways to teach personal finance to high school students, with the most effective ones being the ones that have some sort of game or game-like format. However, most high school students are not learning how to manage their money. In fact, many parents are not even aware that their children are being taught how to be financially literate.

Therefore, in today’s economy where it is difficult to know what financial literacy is, we have seen that financial literacy is important for high school students to learn. Financial literacy is important for any student, but especially for teenagers who will be making major life choices like buying a car or buying a house, getting married, or starting a family. It is also very important for students to understand how money works, and how to make wise decisions about purchasing, paying bills, and saving.

Important Life Decisions

Students have to know their financial situation and the importance of saving, spending, and investing money. They have to know how to set up a budget, how investments work, and how to make money to save and spend. Students have to learn the importance of good credit, good insurance, good home loans, good debt management, and how to pay off debt quickly.

International schools are famous for offering curriculums that are tailor made to help children understand about several important aspects of their adult life. Things like finance, credit, how loans work, what are taxes, etc. are all part of curriculums for higher school certificate. They allow the child to develop themselves and become aware of what is awaiting them in their future.

However, most of them are in a state of uncertainty. They are uncertain about their future life and how to pay for the things that they need to purchase and pay for themselves in the future. They wonder what they can afford, what they need to pay, and when they will have enough money to handle the things they need to do. They are uncertain about their financial situation and their ability to accomplish what they need to do.

To help students learn how to manage finance and a budget it is important to perform research on gross monthly income since it provides a key perspective of a person’s financial situation. Income is very important to determine a person’s financial situation as it is the foremost indicator of how well off a person is. It is not the only indicator, however. The type of work a person does, the type of housing they live in, the type of car they drive, and the type of car they drive are all factors that may affect a person’s gross monthly income.

Taking all mentioned into account we have decided to share the 5 most important lessons about personal finance that should be taught to high school students. These lessons will help students understand the process and the need for personal finance lessons.

Key Concepts to Teach

In the last few years, the educational curriculum in a leading international British school in Singapore has given special attention to financial education for children. This was something that was not taught to kids ever. This prevented them from gaining an idea on financial issues like credit cards, loans, bank accounts, taxes and other elements that everyone should know about.

Today, with all of the uncertainty and stress in the world, it is important to have a plan of action. To create a plan of action, it is helpful to have a good understanding of personal finance or at least its basics like:

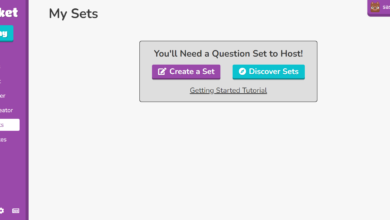

- Budgeting to achieve financial goals. A budget is a detailed plan of how a person or family will spend money during a certain period. The key points here are starting a budget and saving. Also, they should know about the best and most helpful online tools. Students need to know how to make sure they are making the most of their money, and saving for the future. A pay stub generator is a web-based tool that allows a student to receive a printable pay stub once they have provided the necessary information. It is a tool that helps them generate and manage their pay-stub. It will help them get an overview of their current income and expenses and will allow them to track their spending and income over a period of time.

- Consumer skills are based on informed decisions. Consumer decision-making is the process of determining what to buy, how to buy it, and when to buy it. One of the most important lessons that high school students should learn is that they can make smart decisions when they are shopping for a new product or service.

- Understanding the risks of credit and loans. Credit cards, mortgage loans, student loans, and auto loans are all examples of forms of debt that students need to understand. The importance of understanding loan terms and the cost of the loan is often overlooked. If you are borrowing to pay for college, you should know that the cost of your loan will be higher than what you would pay in a month. The key points here are insurance, risk, and debt.

- Reap the benefits of credit and loans. High school students should learn how to effectively manage credit and loans in order to maintain a healthy credit history, increase a credit score, and build wealth. So, credit is the primary financial tool that students should learn about. Students should learn how to effectively manage their credit and loans in order to maintain a healthy credit history, increase their credit score and build wealth.

- Education and career choices have an impact on the quality of life. It is important to realize the earning potential. The determination of how much the student can make by working with someone for a lifetime (whole years) is often referred to as the “economic security” of a job. A lifetime income potential is what you can expect to make when you are in your late thirties, and that is the main reason high school students are so successful in their careers. It’s the highest salary that someone can hope to attain, so it’s a very important number to learn when you’re starting out.

Final Thoughts

The most important personal finance advice for high school students is knowing how to make good and proper decisions with their money. So, for young adults to be successful in life, it is important for them to understand personal finance concepts. This article listed the five most important personal finance lessons that should be taught in high school. These lessons include learning how to manage money, obtaining wealth without risks, and making wise financial decisions.